BlackRock iShares What ETF Titan Brings To Smart Beta Investing Investor's Business Daily

iShares Smart Beta ETFs rewrite the rules of traditional index investing in an effort to deliver targeted outcomes that can help investors reduce risk, generate income, or potentially enhance returns. The ETFs are designed to capture broad, persistent drivers of returns, take advantage of economic insights, and improve diversification.

iShares Smart Beta BlackRock AU

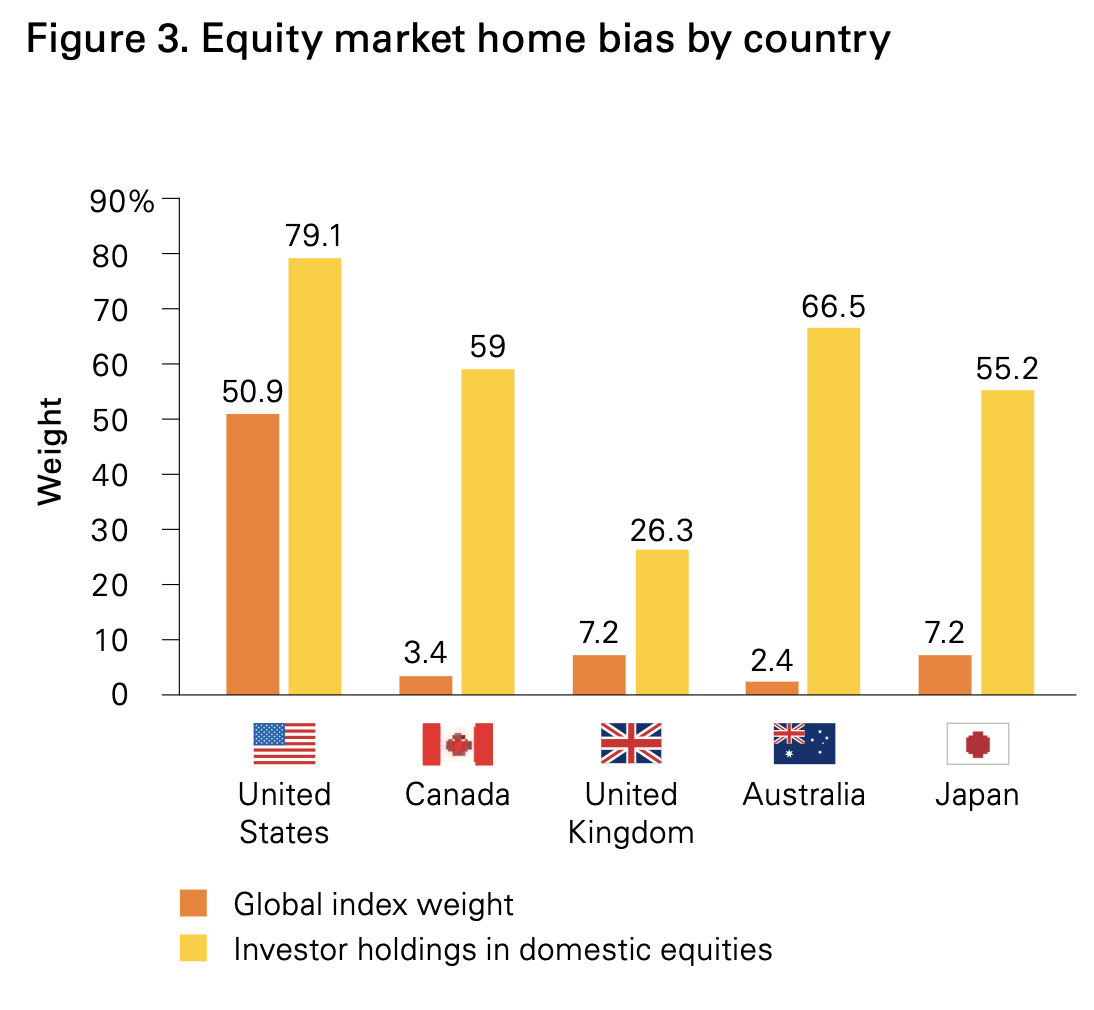

WHAT ARE FACTORS? Factor investing is the strategy of capturing securities with specific characteristics such as value, quality, momentum, size, and minimum volatility. Factors are persistent and well-documented characteristics that can help investors understand differences in expected return.

iShares mit neuen und neuer Anteilsklasse bei SmartBetaETF

Smart beta funds also attracted a more significant increase in assets under management. With net assets of $42.73 billion as of April 2019, the iShares Russell 1000 Growth ETF.

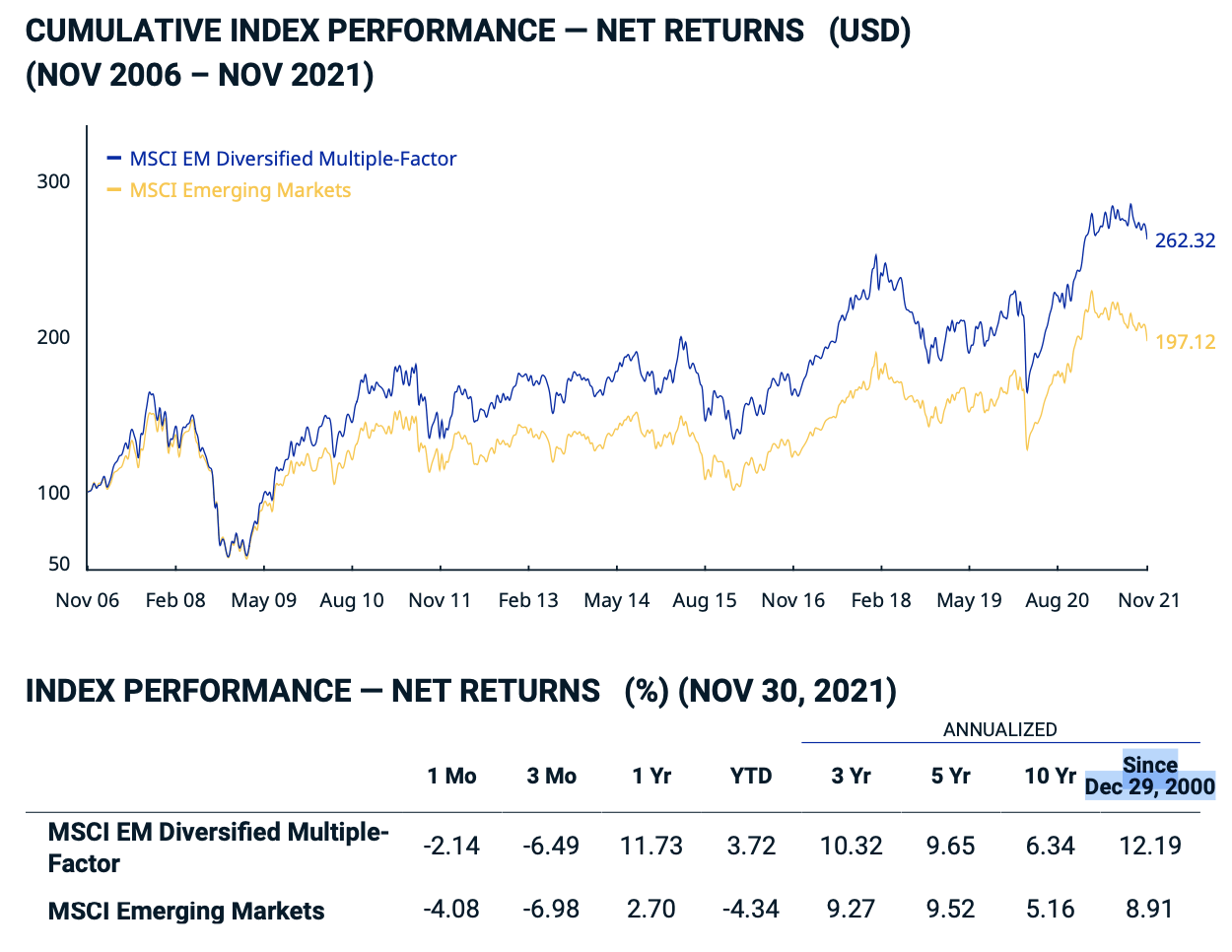

iShares EMGF ETF A Smart (Beta) Way To Play Emerging Markets Seeking Alpha

Multifactor Minimum Volatility Fixed Income ON BLACKROCK.COM Dive deeper into factor investing. Smart beta ETFs capture the power of factor investing, fundamentally changing strategies around investment ideas. Learn more about this new way to invest.

iShares EMGF ETF A Smart (Beta) Way To Play Emerging Markets Seeking Alpha

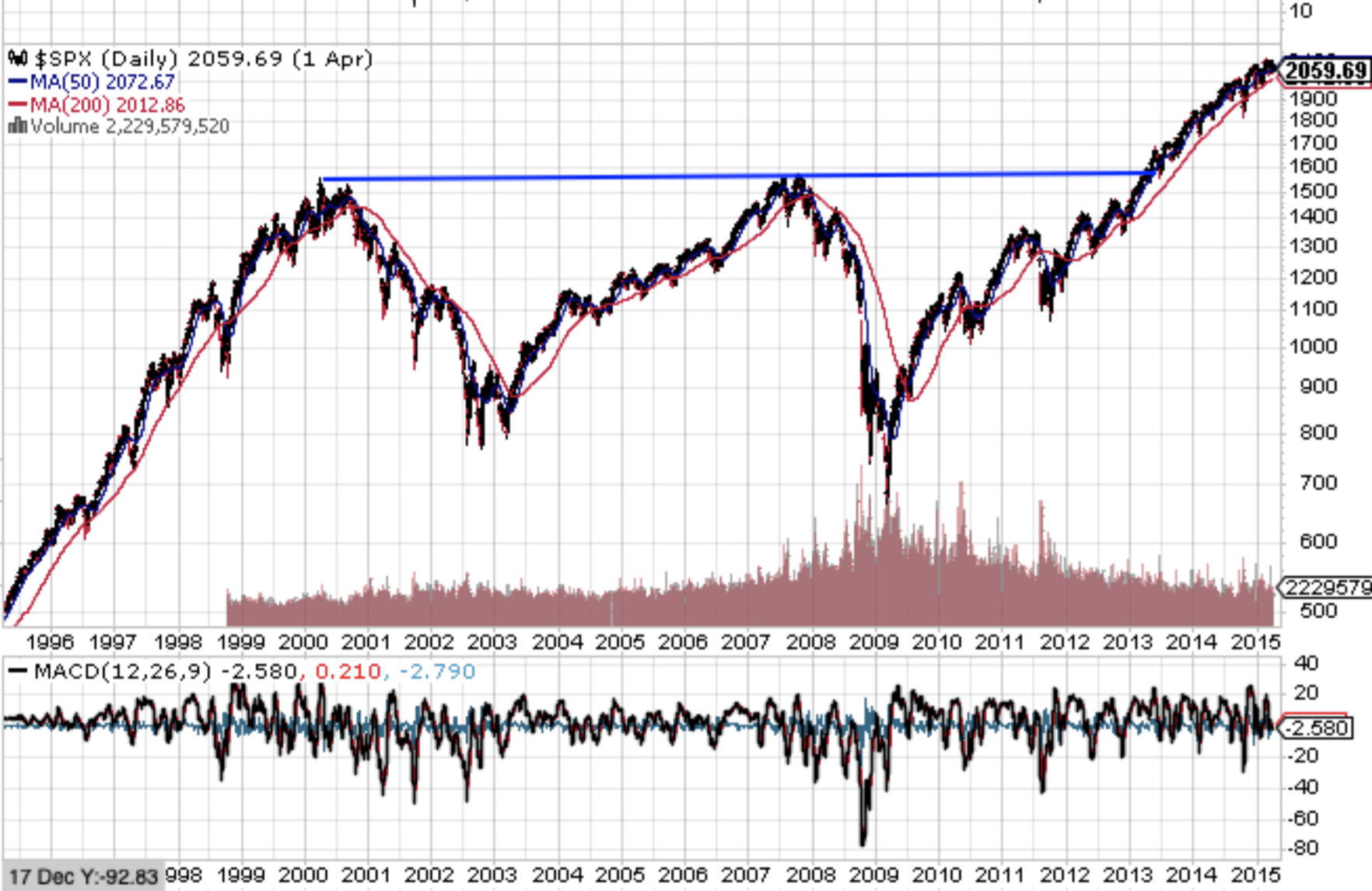

Smart Beta ETFs are funds that follow an alternative weighting strategy compared to the traditional cap-weighted indexes. They are a blend of passive and active investing that adjusts technical and/or fundamental factors such as size, value, momentum and volatility.

IShares Russell 2000 ETF And Vanguard MidCap ETF Ranked Top Smart Beta ETFs

Today smart-beta ETFs command $880 billion in total combined assets. "The past 12 months have been good for 'smart beta,' in contrast to its below-market growth rate in 2016 and 2017,".

iShares EMGF ETF A Smart (Beta) Way To Play Emerging Markets Seeking Alpha

Smart beta refers to an investment strategy that combines elements of passive index investing with those of actively managed investing. The ultimate goal is to outperform a benchmark index while retaining the lower risk and low volatility that are typically mentioned as key elements of index investing. Investment professionals have varying.

Do iShares Smart Beta ETFs Outperform? (Part II) Blog Alpholio™ Ishares, Analysis, Pnc

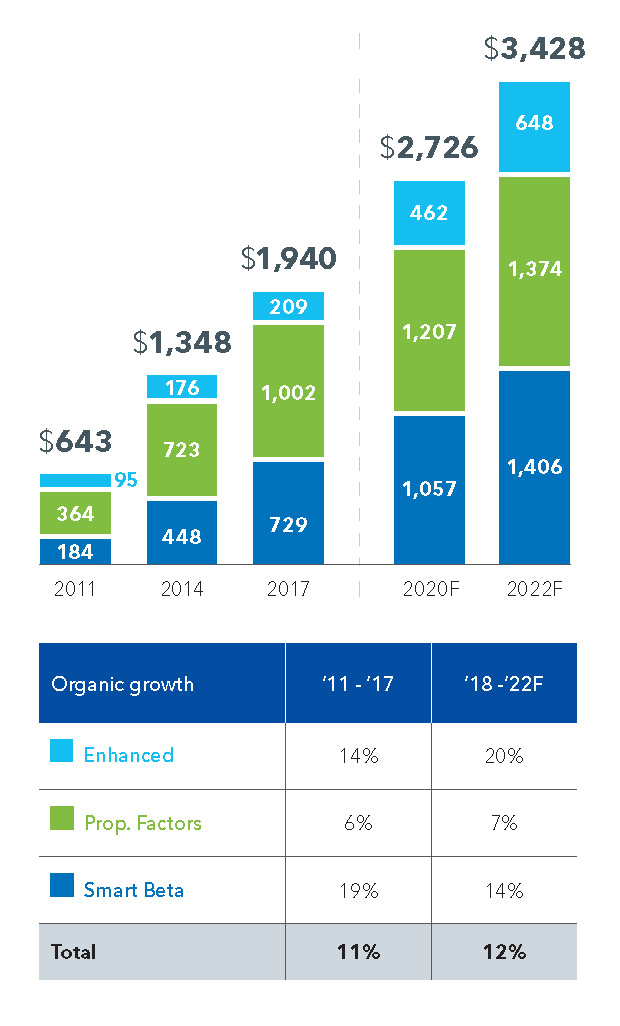

NEW YORK--(BUSINESS WIRE)-- BlackRock's (NYSE:BLK) iShares business, the world's largest manager of exchange traded funds (ETFs), projects that smart beta ETF assets will reach $1 trillion globally by 2020 and $2.4 trillion by 2025. 1 With current smart beta ETF assets at $282bn, 2 this reflects an annual organic growth rate of 19%, double.

Factors making waves by Andrew Ang Smart Beta iShares

A smart beta exchange traded fund, the iShares MSCI USA Equal Weighted ETF (EUSA) debuted on 05/05/2010, and offers broad exposure to the Style Box - All Cap Blend category of the market.

iShares mit zwei neuen SmartBetaETFs

The iShares Semiconductor ETF (SOXX) was launched on 07/10/2001, and is a smart beta exchange traded fund designed to offer broad exposure to the Technology ETFs category of the market.

background smart beta Ishares, Scifi spaceship, Fund

An article to introduce the due diligence frameworks clients can use when implementing smart beta strategies: Purpose, Performance and Purpose.

(LRGF), (SMLF) iShares Rolls Out New Smart Beta ETFs Benzinga

iShares first launched its smart beta range in October 2014 with four ETFs tracking the same risk factors but individually, and they all focused on global equities. Rachael Revesz

iShares EMGF ETF A Smart (Beta) Way To Play Emerging Markets Seeking Alpha

The world's largest smart-beta ETF provider also rebranded its current factor-based funds under the name "iShares Edge.". Including the nine new multifactor sector funds, the iShares Edge.

smartbetainvestingblackrockisharessmartbetaetfs Worthune

It invests exclusively in iShares Exchange Traded Funds which may pay fees and expenses to BlackRock that are in addition to the fees payable to BlackRock for managing. BlackRock Target Allocation Smart Beta 80/20 Model. Allocations - As of 10/19/2023 % U.S. Equity 62.0% International Equity 20.0% U.S. Fixed Income 16.0% Cash 2.0%.

Marco Corsi, iShares "New direction in index investing Thematic, Smart Beta and Sustainable

Looking at smart beta, it's good to understand why the style box is just the beginning. Yes, it's a way to manage and organize exposure, but one must consider h ow risk-management factors like.

HUnX9CMWt7zg_52Id8LBuq7J2qXw7s4KGfZ2L1fs3my7CRRqagViJUK072GLgyFWus0ituE=s900ckc0x00ffffffnorj

What are the benefits of smart beta investing? Performance: Smart beta strategies seek to outperform traditionally weighted index funds, or enhance a portfolio in other ways, such as reducing vulnerability to stock market volatility. These strategies may also provide outperformance relative to traditional active mutual funds.